U.S. authorities on Wednesday charged Archegos Capital Management owner Bill Hwang with racketeering, fraud, and market manipulation over the meltdown of his New York family office which left global banks nursing roughly $10 billion in losses. Archegos, which had $36 billion in assets, collapsed last year after defaulting on margin calls triggered by the unraveling of highly leveraged equity derivative trades.

Among the biggest fund blow-ups in years, the scandal roiled Wall Street, sparked a fire sale in stocks including ViacomCBS and Discovery Inc., and caused Credit Suisse, Nomura Holdings and Deutsche Bank, among other lenders, to lose billions on their trades with Hwang.

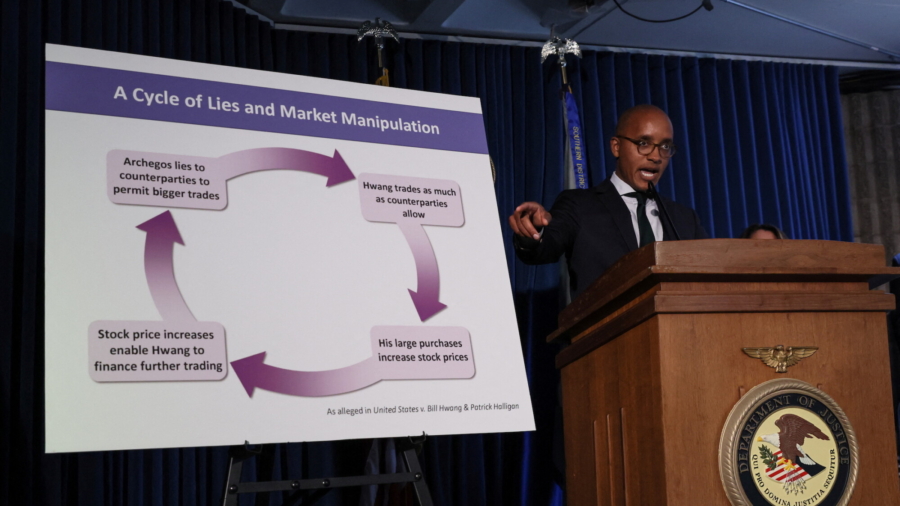

On Wednesday, U.S. authorities alleged that Hwang, who denies wrongdoing, amassed his huge equity exposures by lying to the banks in order increase Archegos’ credit lines and then used derivatives he traded with them to manipulate the underlying shares and ratchet up his returns.

Specifically, Hwang used a type of leveraged equity swap to manipulate the price of seven of Archegos’ portfolio companies, including Viacom, Discovery and Tencent Music Entertainment, according to an indictment brought by the U.S. Attorney’s office in Manhattan. At times, Hwang’s leverage reached as high as 1,000 percent, authorities said.

“Archegos engaged in a brazen scheme to manipulate the market,” the U.S. Securities and Exchange Commission said in a separate civil complaint. “Eventually, the weight of Defendants’ fraudulent and manipulative scheme was too much for Archegos to bear, and over the course of less than a week in late March 2021, the house of cards collapsed.”

Hwang was arrested on Wednesday morning, along with Archegos Chief Financial Officer Patrick Halligan.

Lawrence Lustberg, a lawyer for Hwang, said in a statement that the case had “absolutely no factual or legal basis.” He added: “Hwang is entirely innocent of any wrongdoing; there is no evidence whatsoever that he committed any kind of crime.” He said that Hwang had previously cooperated with the government.

“Pat Halligan is innocent and will be exonerated,” a lawyer for Halligan said.

Prosecutors also brought charges against Archegos head trader William Tomita, and Chief Risk Officer Scott Becker for their alleged roles in the scheme. Attorneys for Becker and Tomita did not immediately respond to requests for comment.

The pair pleaded guilty and are cooperating with prosecutors, officials said during a news conference.

Regulatory ‘Shadows’

The SEC said Archegos “propped up a $36 billion house of cards” by engaging in a constant cycle of manipulative trading, lying to the banks to obtain additional capacity, and then using that credit to engage in more manipulative trading.

The “vast majority” of Hwang’s exposure was via a type of equity derivative written by the banks, whereby they bought the underlying shares but promised Hwang a yield based on those shares’ performance. Those so-called total return swaps gave Hwang exposure to stocks without owning them, the SEC said, allowing him to circumvent an SEC rule that requires individuals who buy 5 percent or more of a company’s stock to publicly report the holding.

Hwang was also able to exploit another regulatory loophole by trading through his family office, a type of private fund that does not have to register with the SEC. That meant regulators and the banks did not have visibility over Hwang’s full exposure, authorities said.

“These defendants committed this fraud in the darkness,” said Damian Williams, U.S. Attorney for the Southern District of New York, said at the news conference.

Hwang’s dealers included Credit Suisse, Macquarie, Morgan Stanley, Goldman Sachs Group Inc., UBS AG, Nomura, MUFG, and Spokespeople for the lenders, other than Deutsche Bank, either declined comment or did not respond to requests for comment.

“While we cannot comment on specific interactions and matters, the bank cooperates with law enforcement and our regulators,” Deutsche Bank said in a statement.

By Jody Godoy