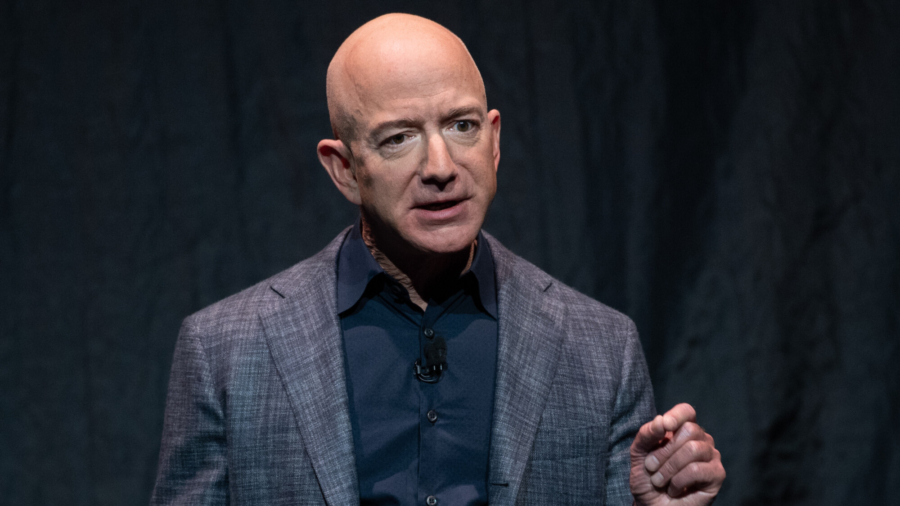

Billionaire Jeff Bezos and the White House are engaging in a war of words over inflation and tax policy.

After President Joe Biden claimed on Twitter that making large corporations “pay their fair share” can lower inflation, Bezos fired back, stating that the federal government’s new Disinformation Board “should review this tweet” and perhaps establish “a new Non Sequitur Board.”

“Raising corp taxes is fine to discuss. Taming inflation is critical to discuss. Mushing them together is just misdirection,” Bezos said.

The administration retorted, arguing in a statement that “it doesn’t require a huge leap to figure out why one of the wealthiest individuals on Earth opposes an economic agenda for the middle class.”

“It’s also unsurprising that this tweet comes after the President met with labor organizers, including Amazon employees,” White House spokesperson Andrew Bates said in a statement.

The Amazon founder added that inflation is a “regressive tax” that affects the least affluent in society and that neither unions nor wealthy households are causing inflation.

“Look, a squirrel! This is the White House’s statement about my recent tweets,” he responded. “They understandably want to muddy the topic. They know inflation hurts the neediest the most. But unions aren’t causing inflation and neither are wealthy people.”

“Remember the Administration tried their best to add another $3.5 TRILLION to federal spending. They failed, but if they had succeeded, inflation would be even higher than it is today, and inflation today is at a 40 year high.”

U.S. price inflation has exploded over the last year, climbing above 8 percent in March. The consumer price index (CPI) eased slightly in April, but broad-based inflation remained at a four-decade high.

White House press secretary Karine Jean-Pierre was also pressed on this subject during a Monday briefing. Fox News Channel reporter Peter Doocy requested additional clarification on how raising taxes on wealthy corporations reduces the cost of gasoline, used automobiles, and food for everyday Americans.

Jean-Pierre purported that Washington needs to support a fairer tax code that can fight climate change, help manufacturing workers, and support fundamental collective bargaining rights.

“But look, without having a fairer tax code, which is what I’m talking about, then all—like manufacturing workers, cops—it’s not fair for them to have to pay higher taxes than the folks who are not paying taxes at all,” she told reporters.

The White House has repeatedly used Amazon as an example of rich corporations not paying their taxes. It has been stated that Amazon avoided paying more than $5 billion in corporate income taxes in 2021 amid record-high profits. Instead, according to the Institute on Taxation and Economic Policy (ITEP), Amazon paid about $2.1 billion in federal taxes or an effective tax rate of 6 percent.

ITEP, a non-profit think tank that studies tax policy, estimated that if Amazon had received zero tax breaks, the company would pay approximately 21 percent of its profits in corporate income taxes, totaling about $7.3 billion, but noted that Amazon is playing by the rules.

“These are tax breaks that Congress has endorsed and even expanded,” ITEP Senior Fellow Matthew Gardner stated in the report. “This means that Amazon’s 6 percent tax rate is a result that lawmakers have enabled and could prevent if they summon the political will to do so.”

But critics charge that Amazon’s tax situation is a bit more complicated than what is being reported. The online retail giant has paid corporate income levies, but the lower tax bills were helped by deductions and incentives pertaining to employee compensations, investment, and research and development. Amazon is ultra-aggressive in reinvesting its profits into the business, be it developing new products and services or expanding its infrastructure. In addition, the company still contributed hundreds of millions of dollars in payroll taxes and more than $1 billion in local, state, and international levies in 2021.

Former Treasury Secretary Larry Summers, who has blamed Biden’s stimulus and relief package for playing a major role in inflation pressures, defended the administration Monday.

“I think @JeffBezos is mostly wrong in his recent attack on the @JoeBiden Admin,” Summers wrote on Twitter. “It is perfectly reasonable to believe, as I do and @POTUS asserts, that we should raise taxes to reduce demand to contain inflation and that the increases should be as progressive as possible.”

At the same time, Summers has dismissed the administration’s billionaire tax and “rejected rhetoric about inflation caused by corporate gouging as preposterous.”

The ‘Tax the Rich’ Crusade

Despite many politicians advocating for closing loopholes in the federal tax code, some conservative and libertarian economists have championed expanding loopholes since it would be a method of cutting overall taxes.

“Let us hope that the tax credit will return in full force. And that we can revive the lost tactic, not of ‘closing the loopholes,’ but of ever widening them, opening them so widely for all indeed, that everyone will be able to drive a Mack truck through them, until that wondrous day when the entire Federal revenue system will be one gigantic loophole,” wrote economist Murray Rothbard in Making Economic Sense, a collection of essays composed in the 1980s and 1990s (pdf).

However, over the last year, U.S. and global public policymakers have presented various tax-the-rich schemes to generate more revenue.

The Organisation of Economic Co-Operation Development (OECD) is poised to ratify a 137-nation agreement to install a minimum 15 percent tax rate on multi-national enterprises (MNEs).

Biden and Democrats have proposed the Billionaire Minimum Income Tax (BMIT), which would institute a 20 percent tax on all income from the wealthiest Americans, including a penalty on unrealized capital gains.

Sen. Joe Manchin (D-W.Va.) has put forward a plan that would help trim the federal deficit, including raising the corporate tax rate to 25 percent, eliminating loopholes, and increasing the capital gains tax. Manchin opposes unrealized gains of billionaires, telling The Hill that “you can’t tax something that’s not earned.”

On the other side of the aisle, Sen. Rick Scott (R-Fla.) proposed the “Plan to Rescue America,” a 2022 election framework that would make every American pay some level of income taxes to have some “skin in the game.”

This one key plank, says Grover Norquist, the president of Americans for Tax Reform, could hurt the Republican Party in November.

“Scott’s call for higher taxes on half of Americans, if not repudiated by House and Senate candidates in 2022 could cost the GOP its winning brand as the anti-tax hike party,” Norquist wrote in an op-ed last month. “Scott suggests that those Americans who do not pay federal income taxes in a given year are somehow without ‘skin in the game.’ Nonsense. All Americans pay the damaging cost of the individual and corporate income tax and federal excise taxes and tariffs imposed by Washington.”

From The Epoch Times