The U.S. annual inflation rate slowed to 3.1 percent in November, down from 3.2 percent, and matching economists’ expectations, according to the Bureau of Labor Statistics (BLS). The latest inflation data suggest the road to the Federal Reserve’s 2 percent target could be a slow journey.

On a monthly basis, the consumer price index (CPI) edged up 0.1 percent, slightly higher than the consensus estimate of 0 percent. This was also up from the October reading of 0 percent.

Core inflation, which excludes the volatile energy and food components, was unchanged at an annual rate of 4 percent. The core CPI rose 0.3 percent monthly.

Food prices rose 0.2 percent from October to November, including a 0.1 percent jump in supermarket costs. In the 12 months ending in November, the food index is up 2.9 percent.

Energy prices declined amid a sharp drop in crude oil and gasoline prices.

The energy index declined 2.3 percent monthly and is down 5.4 percent compared to the same time a year ago. Gasoline costs fell 6 percent monthly and down nearly 9 percent compared to the same time a year ago.

Despite a substantial rally in energy commodities since the end of June, oil and gas have tumbled. West Texas Intermediate (WTI) crude prices have plummeted 19.5 percent over the past three months, adding to their year-to-date slide of 11 percent. A barrel of U.S. crude is at around $71 on the New York Mercantile Exchange.

According to the American Automobile Association (AAA), the national average for a gallon of gasoline is about $3.15, down 3.7 percent from the same time a year ago.

The downward trend has been driven by a shift from supply concerns to demand fears. Investors are worried that a recession or anemic economic growth would weigh on energy consumption volumes, leading to a surplus in international oil markets.

Even with the Organization of the Petroleum Exporting Countries (OPEC) and its allies, OPEC+, cutting production heading into 2024, it was not enough to lift crude prices. This has provided relief for consumers, particularly during the holiday season.

“Historically, crude oil tends to drop nearly 30 percent from late September into early winter with gasoline prices trailing the play,” said Andrew Gross, AAA spokesperson, in a statement. “More than half of all US fuel locations have gasoline below $3 per gallon. By the end of the year, the national average may dip that low as well.”

Elsewhere in the November CPI report, the new vehicle index was flat, while used cars and trucks surged 1.6 percent monthly. Apparel fell 1.3 percent. Transportation services advanced 1.1 percent month-over-month and are up more than 10 percent from a year ago.

Medical care commodities swelled 0.5 percent, while medical care services advanced 0.6 percent.

Shelter, which represents about 35 percent of the CPI data, climbed 0.5 percent. Compared to the same time a year ago, shelter costs are up 6.5 percent.

Market Reaction

Financial markets were mixed following the inflation data, with the leading benchmark indexes flat to kick off the Dec. 12 trading session.

The U.S. Treasury market was mostly up across the board. The benchmark 10-year yield picked up a single basis point to around 4.25 percent. The 2-year yield added one basis point to 4.74 percent, while the 30-year bond tacked on 1.2 basis points to 4.34 percent.

The U.S. Dollar Index (DXY), a measurement of the greenback against a basket of currencies, tumbled 0.22 percent to below 104.00.

Final Inflation Numbers of 2023

Looking ahead to the December CPI, the Cleveland Fed’s Nowcasting model suggests that the annual inflation rate will rise to 3.3 percent, and core inflation will be at 4 percent.

Consumers are optimistic that inflation will slow over the next year, though at a sluggish pace.

According to the New York Fed’s Survey of Consumer Expectations (SCE), one-year-ahead inflation expectations fell to 3.4 percent in November, down from 3.6 percent in October. This was the lowest reading since April 2021, as many participants predicted lower prices for food, fuel, and rent.

One- and five-year horizons were unchanged at 3 percent and 2.7 percent, respectively.

Price pressures persist throughout the economy.

In the Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI), input prices accelerated last month amid greater outputs, material inputs, and labor costs. The ISM services PMI showed the prices subindex remaining flat for the fourth consecutive month in November.

Chris Williamson, the chief business economist at S&P Global Market Intelligence, recently noted that U.S. producers are responding to elevated prices by cutting payroll.

“US producers nevertheless continue to focus on cost cutting by trimming headcounts, and have now taken the knife to payroll numbers for two consecutive months. Barring the early months of the pandemic, the survey has not seen such a back-to-back monthly fall in factory employment since 2009,” Mr. Williamson wrote in a report.

This is leading to lower wage pressures and cooling down raw material input cost inflation, potentially lowering consumer price inflation in the months ahead, he added.

Fighting the Fed

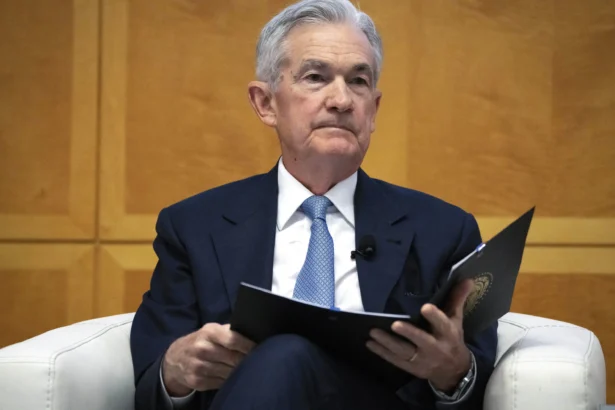

Whether this will encourage the Federal Reserve to loosen monetary policy conditions or not remains to be seen. Central bank officials have discussed keeping interest rates higher for longer to ensure inflation has been eradicated from the U.S. economy. Fed Chair Jerome Powell does not see inflation returning to its 2 percent target until 2025.

However, according to the CME FedWatch Tool, the futures market is penciling in rate cuts in early 2024. It is unclear if investors think this will result from achieving the inflation target or a weaker economy. Still, traders are fighting the Fed and are unconvinced that the Federal Open Market Committee (FOMC) is not even entertaining the idea of pulling the trigger on a rate cut.

The rate-setting Committee will hold its final meeting this week. It is widely expected that the Fed will keep the benchmark Fed funds rate unchanged at a range of 5.25 percent and 5.50 percent.

“The Fed last raised rates in July and we think that marked the peak. There is growing evidence that tight monetary policy and restrictive credit conditions are having the desired effect on depressing inflation,” ING economists said in a research note. “However, the Fed will not want to endorse the market pricing of significant rate cuts until they are confident price pressures are quashed.”

At the final policy meeting of 2023, the Fed will also publish the latest Summary of Economic Projections (SEP). This could offer insight into what governors and officials expect in the coming months, from inflation to interest rates.

From The Epoch Times